UK rural property: Not solving the housing crisis

The Knight Frank Rural Property and Business Update – Our weekly dose of news, views and insight from the world of farming, food and landownership

8 minutes to read

Opinion

The opposition to Labour’s announcement that, if elected, it will allow local authorities to buy land for new housing at its agricultural value, shows how hard tackling the UK’s housing problem will be. The current government’s much watered down reform of the planning system shows policymakers have little appetite to force through unpopular legislation when in power, especially when their own popularity is waning rapidly as highlighted below. While Labour’s proposal to exclude any hope value when compulsorily purchasing land for development has unsurprisingly gone down like a lead balloon with the CLA, which represents landowners, it may just focus minds to come up with other less drastic solutions. The country can’t afford to muddle on for too much longer AS

Do get in touch if we can help you navigate through these interesting times. You can sign up to receive this weekly update direct to your email here

Andrew Shirley Head of Rural Research; Mark Topliff, Rural Research Associate

In this week's update:

• Commodity markets – Fertiliser comes down

• Development – Labour plans to scratch CPO hope value

• Politics – Survey reveals Tory slide

• Natural capital – Asset funds shun biodiversity

• Out and about – The Sandringham Estate

• Shooting – Defra fail to publish new licence

• Compensation – Spud farmer wins damages

• House prices – Country homes take a dip

• Farmland Index – Prices rise in quarter 1

• The Wealth Report – 2023 edition out now

• Farmland Index – Agri-land 2022's top-performing asset

• On the market – Commercial Zambia arable opportunity

Commodity markets

Fertiliser comes down

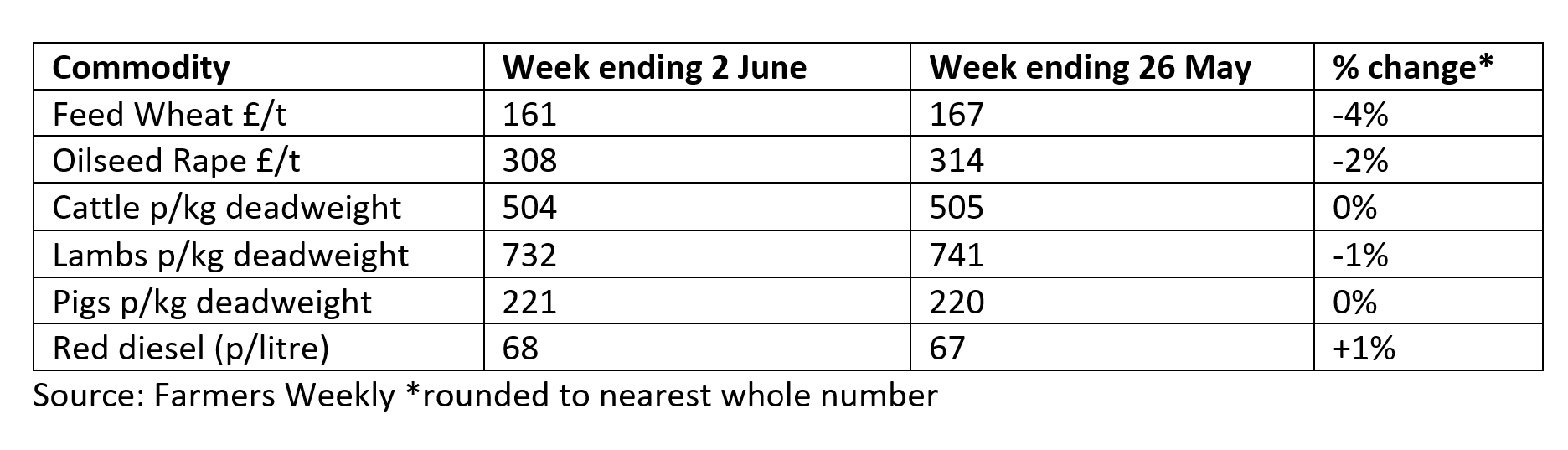

Even though wheat prices have fallen to below half the peaks seen in the aftermath of Russia’s invasion of Ukraine, there are some small crumbs of comfort for arable farmers. Red diesel costs are well down on year-ago levels and falling natural gas prices have pulled back fertiliser values to their lowest levels since 2001. New season nitrogen is now available for just over £300/t AS

Talking points

Development – Labour plans to scratch CPO hope value

Labour is drawing up plans that would force landowners to sell plots for a fraction of their potential market price in an effort to cut home-building costs in England, according to party officials. Lisa Nandy, shadow levelling-up secretary, intends to reform how land is valued when acquired by councils through “compulsory purchase orders” (CPOs), if Labour wins the next general election. The Labour proposal for sweeping land reform would go far beyond recent government moves to allow ministers to make landowners sell their holdings more cheaply on limited occasions AS

Politics – Survey reveals Tory slide

A new survey from the CLA shows support for the Conservatives in rural areas dwindling, although Labour is not particularly trusted to deliver for rural communities either. Polling of more than 1,000 people in England’s 100 most rural constituencies reveals a -18% fall in Tory support and a Labour surge of +16%, putting the Conservatives (41%) and Labour (36%) almost neck-and-neck for the next General Election. The Conservatives currently hold 96 of the 100 most rural seats in England, but applying this trend to the 2019 results would see them lose 20 seats in 2024. Only 36% of those polled agreed the Conservatives ‘understand and respect rural communities and the rural way of life’, with Labour close behind at 31%. AS

Natural capital – Asset funds shun biodiversity

New research by Planet Tracker has found that investors are failing to consider or account for the risks of nature loss. Of 26,500 votes cast between 2010 and 2022, 62% of investors voted against strengthening biodiversity proposals across their funds and portfolios. The importance of a topic to investment managers is to see if it is featured on the agenda at an annual shareholder meeting. If a topic is important enough to be voted on by shareholders, it is likely that investment managers are paying close attention to it. This research reveals that asset managers do not prefer voting in biodiversity proposals as an approach to transforming corporate behaviour on issues such as deforestation.

The report cites the main reasons for voting against biodiversity proxies include that they were “overly prescriptive, already in reports, or provided insufficient shareholder benefit.” In contrast, those investment managers that voted in favour did so to gather more “information on the potential impact of biodiversity-related issues.” I have previously reported on the scale (47%) of London Stock Exchange-listed companies that rely on nature. So for asset managers to argue that there is limited benefit to shareholders is extraordinary.

But hopefully, things will change going forward, and companies will be encouraged via managed asset funds to pay more attention to the positive impact they can have through investing in the countryside and its natural capital MT

Out and about – The Sandringham Estate

Mark and I joined a number of our rural and agri-consultancy colleagues last week on a guided tour of the Sandringham Estate in Norfolk led by Estate Manager Edward Parsons. It was a fascinating glimpse into the running of one of the country’s most high-profile estates. The key takeaway was how forward-looking and innovative the estate is across all of its business units. It’s composting project seemed of particular interest to Mark! AS

Need to know

Shooting – Defra fail to publish new licence

The General Licence (GL43), which permits the release and management of gamebirds on and near Special Protection Areas (SPAs), Special Areas of Conservation (SACs) or within 500 metres of their boundaries, expired on 31 May 2023. It seems that Defra effectively ran out of time in publishing a new GL43. This means shoots should not release gamebirds such as common pheasants and red-legged partridges into these European Protected sites. AS

Zoe Coulson from our Rural Consultancy team in the north of England says: “We continue to monitor the evolving situation regarding the GL43 General Licence and are ensuring we work with our clients who have shoots to ensure that they manage their 2023/24 season around these changes. We all wait to see what DEFRA now produces to replace this.” If you are planning to release gamebirds on or near SPA or SAC sites in the near future, please contact Natural England via gamebirds@naturalengland.org.uk regarding an individual licence MT

Compensation – Spud farmer wins damages

A tenant farmer has won damages of almost £55,000 against an electricity firm that prevented him from growing a crop of potatoes when it damaged a field while laying a new cable. The court ruled in favour of the farmer even though the defendant said the case should be thrown out because the claimant had no formal tenancy agreement with his landlord and was therefore not eligible to make a compensation claim. The judge, however, said in his ruling that the case could have been settled more quickly if all the correct paperwork had been in place and if the tenant’s original claim of over £200,000 had been more realistic. If you need compensation advice please contact one of our experts. AS

House prices – Country homes take a dip

The average value of country houses fell by 0.5% in the first quarter of the year as the cost of borrowing continued to rise, according to the latest findings from the Knight Frank Prime Country House Index. On an annual basis prices have dropped by 0.8%. Demand remains strong, but transaction numbers fell in the aftermath of Liz Truss’s mini budget last autumn. “Ultimately, despite resilient demand, we expect the reduction in spending power caused by the increase in the cost of borrowing and improved supply to see prime regional prices decline by a few percentage points in 2023,” predicts my colleague Chris Druce. AS

Knight Frank Research

Farmland Index – Prices rise in quarter 1

Agricultural land proved resilient in the first three months of 2023. While residential property values weakened, the average price of bare farmland rose by 2%, edging closer to £9,000/acre, according to the Knight Frank Farmland Index. The hike takes the annual rise to 11%, reinforcing farmland's reputation as a good hedge against inflation. Read the full report for more data and insight

You can also listen to the latest edition of our Intelligence Talks podcast where I discuss biodiversity net gain and nutrient neutrality schemes with my Rural Consultancy colleague Isabel Swift AS

The Wealth Report – 2023 edition is out now

Knight Frank's leading piece of thought leadership on property and wealth trends was launched recently and includes an interview by me with one of Scotland's pioneering rewilders, as well as some thoughts on why farmland could be one of this year's most in-demand property investments. Download your copy to find out more AS

On the market

Zambia calling – Commercial arable opportunity

Tanya Ware from our Lusaka office has just launched Wheatlands Farm in Zambia’s Central Province. The 689-hectare arable commercial opportunity is in the Mkushi farming block, Zambia’s agricultural heartland. Over 500 hectares of centre pivot irrigated land deliver wheat yields of over 8t/ha and over 3t/ha of soyabeans. The farm has a 3.6 million cubic-litre irrigation permit. The guide price is US$5.5 million. Contact Tanya for more information. AS