International residential property: sticky inflation prompts diversification

Inflation is sticky across global economies but heading in the right direction.

4 minutes to read

A year ago, few would have thought it would be Eurozone markets that were to offer a glimmer of hope. Spain, Portugal, and France posted much-reduced CPI figures of 2.9%, 3.9% and 6.0% respectively, in May 2023.

In the US, CPI has slipped from 8.9% in June 2022 to 4.9% in April 2023. In the UK, the latest figure is 8.7%, down from a high of 11.1% in October 2022.

Yet despite the declines, the ECB is expected to hike rates. President Lagarde has reiterated, “we are not pausing” and “we know that we have more ground to cover.”

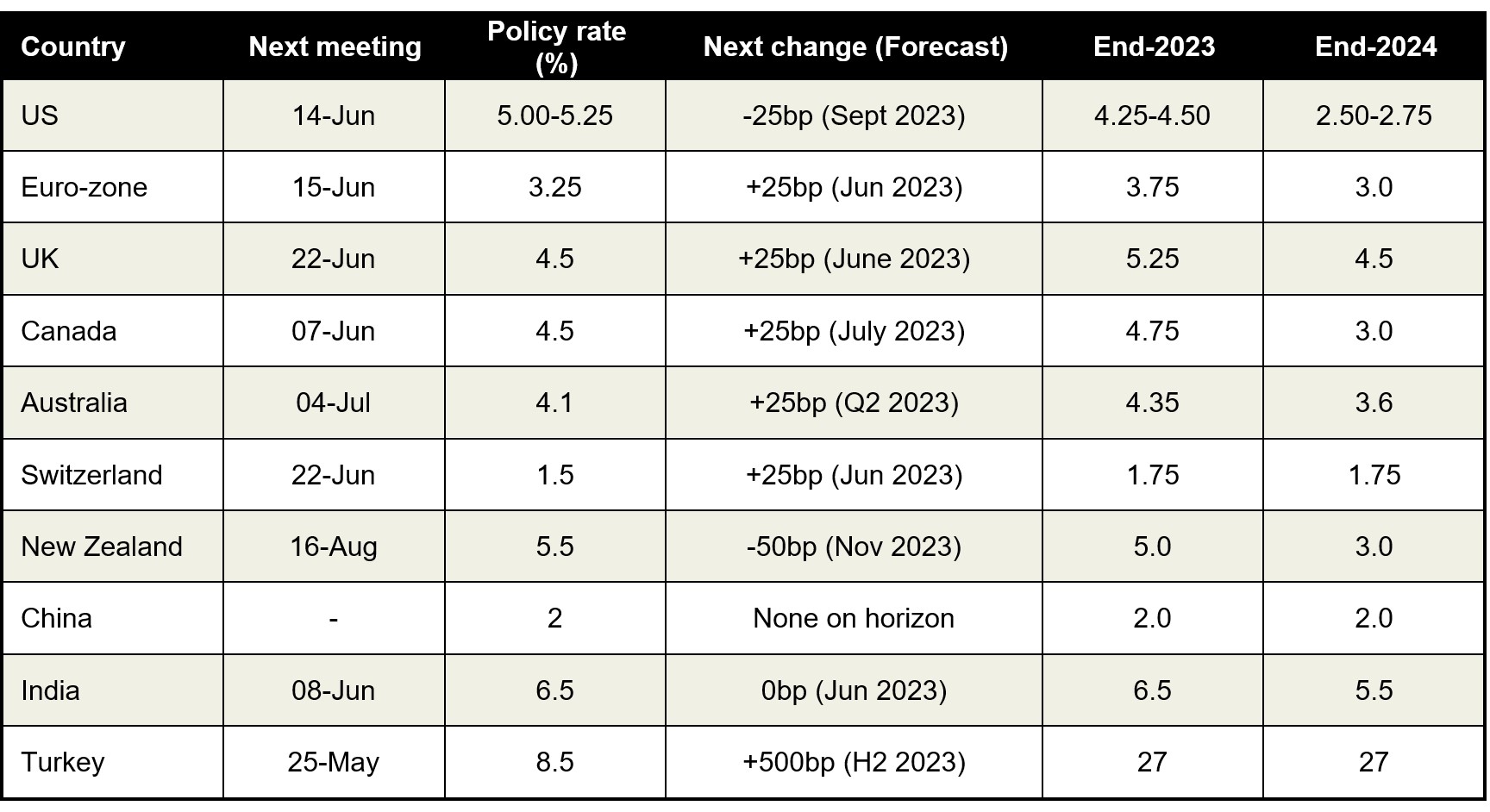

The chart below sets out Capital Economics view of where rates are forecast to sit at the end of 2023 and 2024.

Two camps are emerging. New Zealand’s Central Bank has signalled it has reached its peak; the US may be next, although debate rages as to whether the Federal Reserve will hike again on 15th June.

The second group is comprised of the Eurozone, the UK, Australia and Switzerland, which have further to run.

Once we see one of the major central banks pause or pivot, and policies amongst the major world economies diverge, expect greater volatility in the currency markets, this will present opportunities for some investors.

Prime property prices

Price growth is slowing. Higher mortgage costs are weakening buyer sentiment and hence pricing. In the UK, roughly half of mortgage holders are yet to refinance since the Bank of England started raising rates.

The prime property segment isn’t immune.

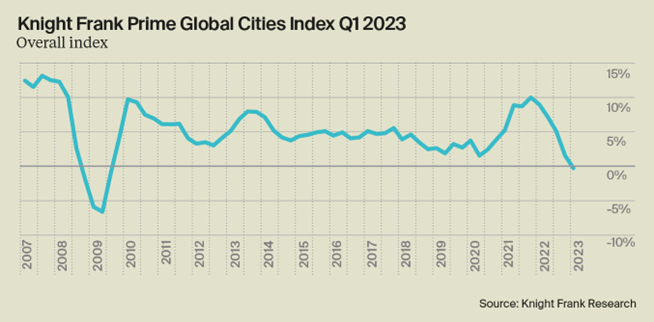

In New Zealand, interest rates have risen 12 times to 5.5% from a low of 0.25% in October 2021. It’s perhaps not surprising therefore, that, New Zealand’s cities sit at the bottom of Knight Frank’s latest Prime Global Cities Index, which tracks the movement of luxury prices in the year to March 2023.

The index fell on an annual basis for the first time since the Global Financial Crisis.

Dubai leads the Q1 2023 rankings, registering 44% price growth annually. Prime prices now sit 149% higher than at the start of the pandemic.

A large proportion of Dubai’s prime demand is from overseas, but homegrown wealth is also surging, as the new Wealth Populations Report confirms.

The number of ultra-high-net-worth individuals (UHNWIs) in the UAE, those with assets of US$30 million or more, including their primary residence, increased by 18% in 2022 to 1,116.

Looking ahead, the number of UHNWIs is forecast to increase the most over the next five years in Hungary (74%), Turkey (69%), Poland (67%) and New Zealand (65%).

Push and Pull

The wealthy are increasingly on the move. Locked down for years during the pandemic, there is a growing appetite to travel or relocate on a semi-permanent basis.

The Wealth Report reveals that 13% of the wealthy are looking to obtain a second passport or citizenship in 2023, a figure that rises to 16% amongst Asian ultra-high-net-worth individuals.

But this is happening at a time when some policymakers are pulling up the drawbridge.

The world is increasingly polarised, with some countries looking to attract investment and overseas buyers via visa, family office or flat tax initiatives (Dubai, Barbados, Italy), while others are looking to deter such inflows by ending Golden Visa programmes (Portugal, Ireland) and introducing foreign buyer bans (Canada and New Zealand).

This means it will be a more complex landscape for the wealthy and their advisors to navigate. Changes announced to date in 2023 have come with little warning.

Unlike in 2008, new visa initiatives are not linked to property acquisitions, instead, the focus is on job creation, innovation or capital investments as governments come under increasing pressure to tackle housing affordability and plug pandemic-induced deficits.

Digital nomad visas that popped up during the pandemic as tourist-deprived markets looked to stimulate their local economies with a new intake of untethered freelancers, tech and creative types are gathering pace, with Spain recently launching its own version, offering non-EU residents a means of circumnavigating the post-Brexit 90/180-day rule.

Diversifying property portfolios

Against an uncertain economic backdrop and with more markets seeing price corrections, 14% of UHNWI’s plan to diversify their property portfolios in 2023, according to The Wealth Report.

For some, it’s a hedge against inflation; for others, the motive is to spread risk in a slowing market.

Alternative asset classes are in the spotlight, from student accommodation to senior living, and from solar farms to vineyards.

High on their wish list is income security, consistent consumer demand and a high turnover of tenants, enabling frequent rental reviews are in favour.

Investors’ horizons are also expanding. As key economies teeter on the edge of recession, investors are looking to minimise their reliance on one market’s economic fortunes to mitigate risk. Exposure to multiple tier-one markets that offer liquidity and transparency is a defensive stance many are adopting.

US buyers are looking to the UK and Europe, buoyed by the strong dollar. Middle Eastern buyers are looking at Paris, London and New York. Latin American buyers are favouring Miami, Madrid and Lisbon, whilst Asian buyers are targeting London, New York, California and Sydney.

Read more from Kate or get in contact: Kate Everett-Allen, head of international residential research

Subscribe for more

Subscribe to the Global Residential Newsletter to keep up to speed with the latest trends influencing global residential property markets.

Subscribe here